When you are planning to set up an ecommerce store, do you know what the most tricky yet essential thing to consider is?

It’s the choice of payment modes that you must enable on your site.

Yes, we know that you are designing a web store, and the primary notion behind it is CONVERSION. Unlike the static websites, you are going to get real money transferred to your bank accounts for your sales.

To accomplish this goal, you have to think about the best options to get paid.

Don’t be hard on your customers by enabling a single payment method. Rather, be generous! Enable different payment options at your store to enhance the opportunities of conversion.

There are different online as well as offline payment methods that you can count on. Remember the days when money order, bank deposit, and cheque were the only payment options. But, thanks to technology, that’s not the case now. When NEFT/RTGS/IMPS marked the beginning of the instant payment methods, credit card, debit card, and net banking became renowned participants in the race. And, now UPI and digital payment wallets are in the trend.

While counting on the frequently used payment methods, credit cards and mobile payments are inevitably leading. Especially if you are dealing in the international market around North America, Asia Pacific, and Europe, you will get more credit card users. Bank transfers were getting reduced, but UPI made the mobile to bank payments and direct bank transfer swift and more secure.

How to enable these payment methods?

We had enough discussion about the ecommerce payment methods that you can enable in your store. As you’ve seen, there are numerous options available. Now, your challenge is to choose the way with which we can allow these payment methods in your ecommerce store. There comes the role of e-commerce payment gateways.

What is an ecommerce payment gateway?

E-commerce payment gateways or digital payment gateways are ecommerce services that process the payment information for different websites they are integrated with. The payment gateway generates a link between the user and the bank between which the transaction is taking place. Ecommerce payment gateways enable:

The quick and trouble-free checkout process

Did you ever leave the site during purchase, as it was taking so much time or asking for a lot of details?

Yes, we know that’s not fair! But it happens. The complicated checkout process is the fundamental reason behind the cart abandonment. 70% of customers leave the shopping cart without making the purchase.

That’s a huge count!

The availability of best deals, product variations, and competitive pricing are also the reasons. But, too many details can also make customers leave.

An excellent online payment gateway makes the checkout process easy and swift, so you get the most of those sales rather than losing them.

Offer encryption to safeguard customer’s data

The identity theft implies that every online transaction a shopper makes needs trust. The sensitive information is encrypted from hackers worldwide that desire to steal credit card data from vulnerable sites.

As payment gateways specialize in processing financial data, they have the exact safety and encryption features to keep your customers’ data safe.

5 Best Ecommerce Payment Gateways That You Can Rely On

Here’s a shortlist to assist you in figuring out which type of payment gateways will work best for your ecommerce business.

Stripe

Stripe is a significant payment method in the market now, and it’s so versatile.

It’s a perfect choice for an ecommerce store, on-demand marketplaces, or subscription services. So for those of you who run a business with multiple services, this is the most recommended method you ought to take into consideration.

Another best feature of Stripe is the easy set up of recurring payments that you can take from the customers.

It additionally supports payments in online, as well as in-person mode. So if you’re running a brick and mortar store, you can add a Stripe POS system to the gateway on your ecommerce site. In this way, you can work consistently across both marketplaces.

Studies demonstrated that brands utilizing Stripe had increased revenue by at least 6.7% after implementing the payment gateway. You’ll see 81% fewer outages and 24% less operating expenses compared to rivaling payment methods.

Stripe accepts all popular debit cards and credit cards from all countries, including:

- Mastercard

- American Express

- Visa

- JCB (Japan)

- Discover

- UnionPay (China)

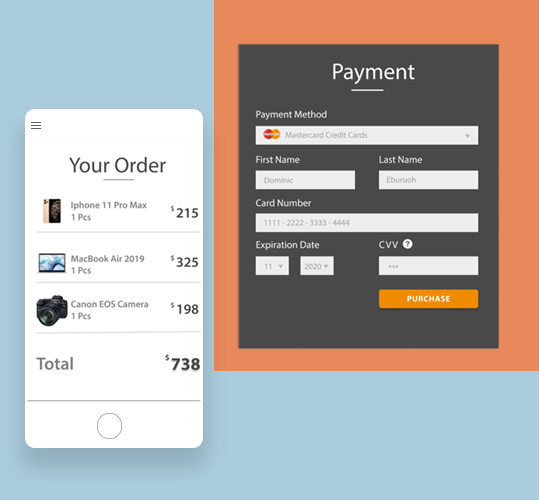

PayPal

We believe that many of you are quite familiar with PayPal. Its reputation speaks for itself when it comes to ease of utilization, security, and reliability. This is the reason you must think about adding PayPal to your website.

As per Statista, there are nearly 277 million active PayPal users worldwide in 2019. That number is growing from 237 million from the starting of 2018.

Simply put, there are tons of shoppers, and they are continuing to grow. Additionally, people might have a PayPal balance that they need to use for spending, as opposed to charging a debit card or credit card.

Here’s another thing you need to consider. Websites utilizing PayPal checkout convert at an 82% higher rate than sites don’t use PayPal.

With PayPal for ecommerce, you can accept:

- Credit cards

- Debit cards

- PayPal

- Venmo

- PayPal Credit

PayPal charges transaction fees both into and out of your account. So, it can be a bit expensive option for ecommerce store owners dealing in large volume, low-value products. The expected payment will be 30 cents, in addition to 2.9% of each of your sales. But, believe us, it’s worth investing.

Apple Pay

Apple controls more than 56% of the mobile vendor market share in the U.S. So, it’s better to say that there are a lot of people in America walking around with iPhones in their pockets.

iOS users utilize Apple Pay as their digital wallet.

Once people finish setting it up on their devices, they can pay for items with just one click. This is an excellent update for your ecommerce store. You don’t have to panic about people filling out long-form fields with their billing addresses and credit card numbers.

For users who are purchasing from your mobile app or mobile site, they can make the payment just by utilizing a facial recognition or fingerprint. It doesn’t get much simpler than that.

Amazon Pay

Amazon is already everyone’s favorite. Earlier it was only for the businesses to explore B2C and B2B market, but now you can be benefited by the trusted platform to grow the trust of your business. Amazon Pay and linking to UPI enables you to make a direct payment via the most secure payment gateway.

It not only eliminates the risk of fraud but rather also enables you to get benefits of Amazon Pay Gift cards and cashback offers. You can opt for EMI options while making the payment via Amazon Pay. The best thing, Amazon doesn’t charge you anything on the EMI options.

Linking the Amazon Pay to your website won’t take a lot of time. You can opt for API integration with the help of your technical team to improve the user experience. Amazon Pay costs you 30 cents plus 2.9% of each of the transactions. By integrating Amazon Pay to your ecommerce store, you enable your national as well as international customers to purchase from your store.

Google Pay

Last but not least, on our list is another fantastic digital wallet provided by one of the most renowned companies’ names in the world.

It’s Google Pay from Google!

Google Pay is available for mobile apps, ecommerce shops, and in-person checkouts.

Industry giants like StubHub and Airbnb have already included Google Pay to their checkout processes. After adding the new Google Pay API to their site, StubHub saw a more than 600% increase in unique visitors purchasing with Google Pay.

Shoppers are surely starting to get more familiar with it. Google Pay is easy to integrate into your ecommerce platform. Simply access the API and integrate it into your site. After some tests, it will be ready to work.

Why Propose Multiple Online Payment Methods?

Today, many customers expect to utilize their most preferred payment methods on sites across the web.

Also, if they won’t find the preferred option, they won’t take a second to explore the alternative business offering a similar product or service.

since each ecommerce payment gateways have their distinct benefits, it’s better if you compare and check them.

Different online payment modes enable your customers to select and go ahead with the most convenient payment option. And, if one of the provided options fail because of the network issues or downtime of the site, your customers won’t feel stuck. It will automatically increase your conversion rate and help you in flourishing your business.

Conclusion

Your ecommerce site is of no use if you can’t get the payment. It’s time for you to know that all of your shoppers don’t have similar preferences.

You have to offer them as many alternatives as possible to boost your conversion rates. Digital wallets are proliferating in the market. It’s simpler for users to utilize these alternative payment methods as opposed to manually entering their payment details. This reduces the friction in the checkout process.

Even when you are enabling all-digital payment options, don’t forget to add offline payment modes to your store. There is a huge count of customers who still believe to order the products, only if COD is enabled on the site. It gives your users the freedom to explore options and get the best deal. We know that it is a bit risky or aids the product cancellation rate. But, that’s the competitive factor in the market.

That is the reason why you ought to think about integrating these payment methods to your store. The more options you offer, the better it will be for you in the long-term.